Welcome in order to the dynamic planet of payment running, where seamlessly facilitating transactions has become the lifeblood of modern businesses. From traditional brick-and-mortar stores to the booming realm of e-commerce, understanding typically the intricacies of payment processing is essential regarding any organization aiming to thrive in today's competitive landscape.

Whether you're a seasoned businessperson or possibly a budding new venture, grasping the principles of payment running is paramount. The landscape of payment solutions is vast, encompassing a myriad of choices tailored to fit businesses of just about all sizes and companies. As being the heartbeat of financial transactions, delving into the intricacies of payment processing systems can substantially impact your functional efficiency and final conclusion.

Just how Payment Processing Works

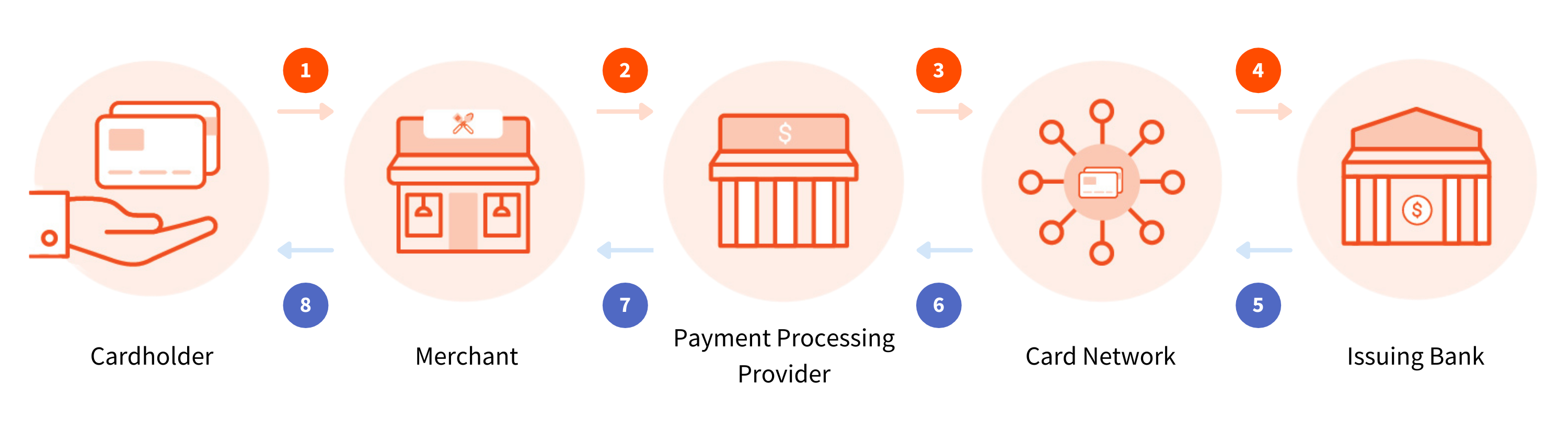

Repayment processing is a new fundamental aspect of conducting business deals in today's digital world. It involves the seamless exchange of funds through a customer's accounts to a merchant's account in change for goods or even services rendered. The method begins when a new customer initiates a payment, either on the internet or in-person, making use of a credit-based card, debit card, mobile wallet, or even other payment approaches.

As soon as the payment is initiated, the transaction information is safely transmitted to some repayment gateway, which serves as a bridge involving the merchant's site or point-of-sale system and the financial corporations involved. The payment gateway encrypts the particular data to safeguard sensitive information and even sends it to be able to the acquiring loan provider, which then transfer the transaction specifics to the client's issuing bank for authorization.

After receiving consent in the issuing bank, the acquiring financial institution processes the transaction and transfers typically the funds to typically the merchant's account. This particular entire process usually takes only some sort of few seconds to be able to complete, providing the smooth and successful experience for the two customers and retailers alike.

Choosing the Right Payment Cpu

Any time deciding on a payment processor to your business, that is crucial to consider various factors to ensure a seamless purchase experience. First, measure the compatibility of the particular payment processor together with your e-commerce program or point-of-sale system. Seamless integration will streamline operations and even enhance client satisfaction. Furthermore, look for the payment processor that will offers a range of repayment options to serve to diverse buyer preferences and enhance flexibility.

Another key thought when choosing some sort of payment processor is reliability and security. Opt for a processor together with robust security features for example encryption plus tokenization to safeguard sensitive payment information. Additionally, reliable consumer support is essential to address any concerns promptly and minimize disruptions to the payment processing operations. Conduct thorough study and read reviews to gauge the particular reputation and trustworthiness of the repayment processor before producing a conclusion.

Lastly, cost-effectiveness works a substantial role inside selecting the most appropriate payment processor. Compare pricing constructions, including transaction charges, monthly subscriptions, and even additional charges, to be able to identify a solution that aligns using your budget plus offers transparent charges. Evaluate best merchant services ISO program ’s payment volume and average transaction dimensions to determine the particular most cost-effective settlement processor that maximizes your important thing when maintaining quality support for your buyers.

Foreseeable future Trends in Repayment Control

Inside the fast-paced globe of payment processing, staying in front of emerging trends is vital regarding businesses to continue to be competitive. As technology continue to be evolve, we can expect to see increased adoption regarding biometric authentication methods, such as finger print or facial reputation, enhancing security and streamlining the settlement process for clients.

One more key trend on the horizon is the rise involving contactless payments, motivated by the growing popularity of cellular wallets and wearables. Using the convenience and speed of tap-and-go transactions, more companies are anticipated to spend in contactless settlement terminals to meet up with the demands of tech-savvy consumers looking regarding seamless payment suffers from.

In addition, artificial intelligence in addition to machine learning are really poised to revolutionize payment processing by simply improving fraud diagnosis capabilities and personalizing the customer payment journey. Whether is actually detecting unusual spending patterns or promoting tailored offers with the point of sale, AI-powered remedies will play a crucial role in framing the future regarding payment processing within the years to be able to come.